Please click "Continue" or you will be logged out.

Logging out

Port Richmond Savings - Your Community Bank in Philadelphia

x

Just a reminder that we will be closed on Monday, February 16 for Presidents' Day. Thank you!

What Is the Difference Between a Debit Card and a Credit Card?

Debit cards and credit cards are both quick and convenient ways to make purchases in-store, online, or over the phone. They look identical, so what is the difference between a debit card and a credit card? The main difference lies in how they operate.

Debit Cards

Debit cards function in the same way writing a check does. Linked to your checking account, they deduct funds almost immediately upon making a purchase. Because you are paying for your purchase up front, there is no bill later or accruing interest. If you try to spend more money than you have, you may be charged overdraft fees. Debit cards can also be used at ATMs (automated teller machine) to withdrawal cash out of your checking account.

Credit Cards

Credit cards on the other hand, provide a line of credit, allowing you to borrow money and repay it later. You typically receive a monthly bill and if you don’t pay it on time or in full, late fees or interest charges may apply.

Benefits of a Debit Card

- Since you can only spend the money in your checking account with your debit card, they offer a great way to avoid credit card debt.

- There are no interest fees or late payments.

- Debit cards also offer an easy way to obtain cash when you need it by using an ATM.

- Some merchants also have a cash back option when you use your debit card to make a purchase with them.

Benefits of a Credit Card

- Credit cards are good to have in case of an emergency, when you need to save money before paying the bill.

- Credit cards also allow you to build credit history which is necessary for when you want to apply for a loan.

Security

Both debit cards and credit cards offer multiple security features to protect against fraudulent activity. However, you always need to be on the lookout for fraud and theft. If your credit or debit card is ever lost or stolen, contact your provider as soon as possible. With your PRS Debit card, you are able to freeze your card in your Online or Mobile Banking accounts.

The Fair Credit Billing Act (FCBA) protects credit card users from fraudulent charges, and oftentimes credit card companies will offer additional protections. The Electronic Funds Transfer Act (EFTA) protects debit cards users but because debit cards pull money directly from your account, time is of the essence. You have sixty (60) days to notify your bank of any unauthorized charges in your account.

At Port Richmond Savings, our PRS Debit Card has customizable card controls within your Online or Mobile Banking account. You can set alerts to receive texts when certain types of transactions or amounts are being placed on your card. Your PRS Debit card is also monitored for purchases outside of your normal purchasing patterns, unusual timeframes and geographical locations, as well as purchase patterns consistent with identified fraud trends. If such activity is detected, Port Richmond Savings will contact you through our Card Alert Notification Service.

Should I have a Debit Card or a Credit Card?

In summary, debit cards and credit cards, though they look identical, work differently and therefore can serve different purposes. Most people find it a good idea to have both in their wallet. At Port Richmond Savings, you can obtain a free PRS Debit Card when you open a checking account with us. Use your PRS Debit Card to keep your daily spending under control and to get the cash you need at ATMs.

If you already have a checking account at Port Richmond Savings and are in need of a debit card, give us a call at 215-634-7000 and we will get you set up right away.

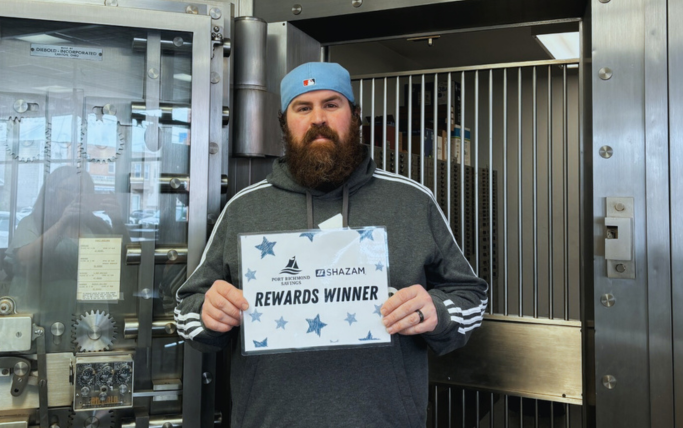

Every time you use your PRS Debit Card, you will be entered into a monthly drawing for the chance to win $50!